Oil prices slipped on Monday, extending last week's losses after coming under pressure over the past month from rising production in the United States, Libya and Nigeria.

The rising output has taken the edge off an OPEC-led initiative to support the market by cutting production. Signs of faltering demand have also prompted weakening sentiment, dropping prices to levels not seen since before the output cuts were first announced late last year.

U.S. West Texas Intermediate (WTI) crude futures ended Monday's session 54 cents, or 1.2 percent, lower at $44.20 per barrel, the weakest closing level since Nov. 14.

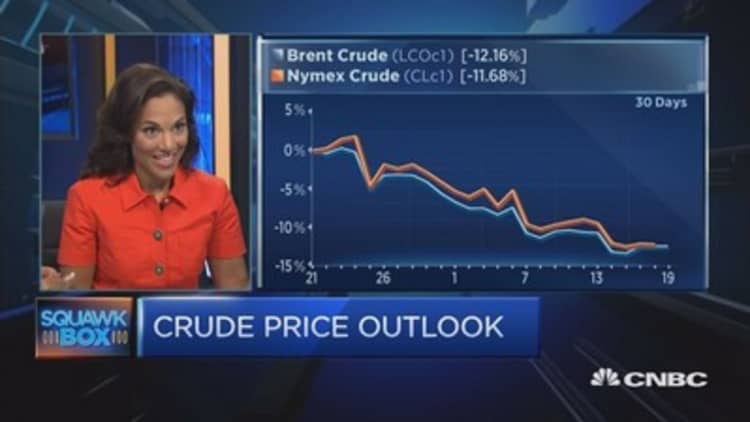

Brent crude futures were down 40 cents at $46.97 per barrel at 2:34 p.m. (1834 GMT). They posted a fourth straight weekly drop on Friday.

Prices for both benchmarks are down around 13 percent since late May, when producers led by the Organization of the Petroleum Exporting Countries extended a pledge to cut output by 1.8 million barrels per day (bpd) for an extra nine months.

Analysts said a steady rise in U.S. production, along with output increases in cut-exempt Libya and Nigeria, were undermining the OPEC-led effort.

"There is no reason to be overly optimistic at the moment," said Commerzbank analyst Carsten Fritsch.

"Anyone who is looking for the bottom of the current price fall must keep his or her eyes on the supply-side equation and only get optimistic if the factors that have been driving oil prices lower since the end of May change," PVM analyst Tamas Varga said.

Libya's oil production has risen by over 50,000 bpd to 885,000 bpd after the state oil firm settled a dispute with Germany's Wintershall, a Libyan oil source told Reuters on Monday.

In May, OPEC supplies jumped on the back of recovering output from Libya and also Nigeria.

Data on Friday showed a record 22nd consecutive week of increases in the number of U.S. oil rigs, bringing the count to 747, the most since April 2015.

Investment bank Goldman Sachs said if the rig count holds, U.S. oil production would increase by 770,000 bpd between the fourth quarter of last year and the same quarter this year in the Permian, Eagle Ford, Bakken and Niobrara shale oilfields.

There are also indicators that demand growth in Asia, the world's biggest oil-consuming region, is stalling.

Japan's customs-cleared crude imports fell 13.5 percent in May from a year earlier, the Finance Ministry said. India took in 4.2 percent less crude in May than it did a year before. In China, oil demand growth has been slowing for some time, albeit from record levels.

Saudi Energy Minister Khalid al-Falih said the oil market needed time to rebalance, pointing to a draw of around 50 million barrels from floating storage and a drop in industrial nations' onshore storage compared to July last year.

"All signs point to significantly tightening in the oil market in the coming months," Fritsch said.

— CNBC's Tom DiChristopher contributed to this report.