Cupertino’s brief second flirtation with putting an Apple Inc.-targeted business tax on the November ballot to pay for transportation improvements died a quick and unanimous death Tuesday night. It may have been killed by Elon Musk’s hyperloop idea as much as the four City Council members who voted it down.

“We are talking to hyperloop to have a line, hopefully, along Stevens Creek from Diridon Station to DeAnza College,” Councilmember Barry Chang blurted out just before the postponement vote.

Mayor Darcy Paul said in an interview afterward with the Silicon Valley Business Journal that Chang’s hyperloop revelation surprised him. It came immediately after a cryptic comment of his own intended to hint at the secret without revealing it.

But he said he believes there’s a strong possibility that Silicon Valley tech companies like Apple would “heavily subsidize” construction of a cutting-edge transportation solution in their own back yard and that no new tax should be imposed until that possibility is fleshed out.

“There could be very significant amounts of private sector funds willing just to invest in an early line so that, you know, that particular sector or company can use it as a bit of a showcase,” he said.

'A very expensive solution'

Paul had just explained from the dais why he thought the council should give the city staff more time to come up with a transportation plan that might rely on a partnership with Apple, which sent its government liaison executive to publicly speak for the first time on the tax issue.

“We are looking at the potential for a very expensive solution,” Paul told the crowd in City Hall. “There are some transit companies out there that are so motivated they are thinking about delivering transit solutions around the world. And if, in Silicon Valley, they can start implementing them, that translates to a huge leveraged opportunity in the sense that if someone wants to say, ‘Look, we’re in Silicon Valley, we’re effective, it’s a relatively new technology that we’re trying to showcase to the world.’ That’s not a $7 million opportunity, that’s not a $10 million opportunity. It might be a hundreds of millions of dollars opportunity …”

According to Paul, Chang met early this year with the CEO of a company attempting to develop Musk’s idea of magnetically levitated vehicles propelled through a nearly airless underground tube at hundreds of miles per hour.

Paul himself has met with Hyperloop Transportation Technologies, or HyperloopTT, a Culver City-based hyperloop developer. HyperloopTT announced a deal last month to build a commercial system in the Chinese province of Guizhou. In April it began building a test track in France.

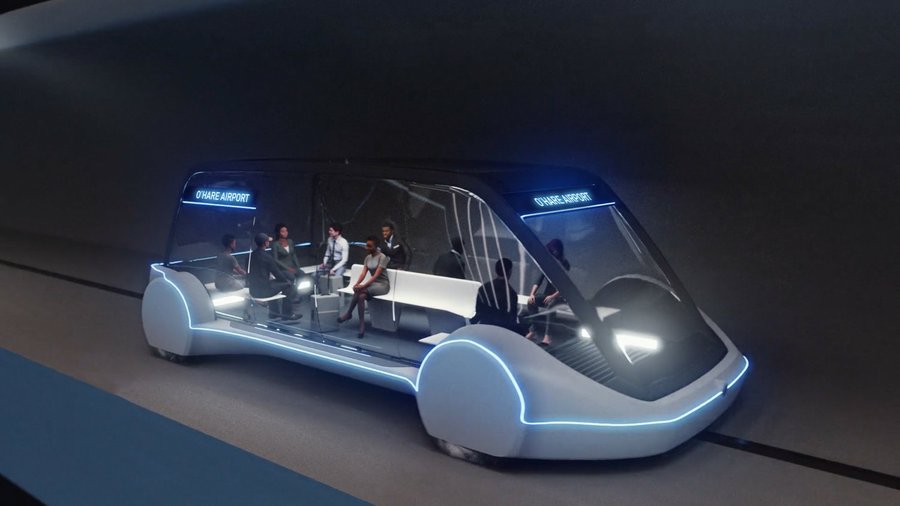

At the same time — Musk, who is CEO of Tesla Inc. and SpaceX and has several other smaller technology ventures — has been pitching his tunnel-digging business, The Boring Co., as a way to build tunnels faster and cheaper. The company obtained Maryland’s permission last fall to tunnel from Washington to Baltimore for a hyperloop line and in June the company said it was awarded a bid to tunnel from downtown Chicago to O’Hare Airport.

However, none of these announcements have said how much these projects would cost or committed anyone to pay for them.

In the worst case scenario in Cupertino, Apple would have faced a $9.4 million annual tax bill if voters in November had approved the larger of two draft business taxes based on the number of people it employs there. Apple pays about $17,000 now, according to a city staff report. It’s new tax bill would be 92 percent of the $10.2 million total tax revenue that the November ballot measure was designed to raise.

Would Apple pay?

Would Apple really pony up what would likely be billions of dollars for a transportation technology that doesn’t even exist to avoid a tax bill of a measly few million?

“It's a fine balance between — how do we make sure that everyone's acting in good faith here?” Paul said.

Business organization leaders as well Cupertino residents lined up during the public hearing to talk about the danger to the city’s economy if it raised taxes on the company that employs two-thirds of the city's workforce.

“Our region’s largest employers have choices where they can locate or relocate their employees,” said Matt Mahood, president of the Silicon Valley Organization, the region’s largest chamber of commerce.

“In Apple’s case, they can relocate in San Jose, where they own 87 acres and are entitled to build 4.4 million square feet of new office space. In San Jose they passed a recent modernized business tax. It’s something they put together a nine-month period, got the business community’s buy-in, went to the ballot without the opposition of the chamber of commerce and it’s capped at $150,000 a year.”